| 6/6/2017 1:14:32 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

Great Debt Unwind: Bankruptcies by Consumers and Businesses Jump

http://wolfstreet.com/2017/06/06/bankruptcies-consumers-businesses-rise-2017/

When it comes to consumer bankruptcies, other forms of debts are the primary drivers: largely student loans, auto loans, and revolving credit such as credit cards. And a big one: debts related to medical treatments, such as emergency room bills.

And there is a lot of this debt. Credit card debt, at $1 trillion, is just one notch below the peak during the Financial Crisis. But auto loan balances outstanding have surged 36% from the pre-crisis peak in 2006 to $1.12 trillion in Q1 2017. And student loan balances outstanding have surged 180% over the same period to $1.44 trillion. This amounts to over $3.5 trillion plus medical debts.

While student loans cannot be discharged in bankruptcy, they can be drivers when other debts are involved and the combined debt burden is simply too large for consumers to carry. And they buckle.

Delinquencies on credit cards, according to the Federal Reserve Board of Governors, have been ticking up from the lows of the first half in 2015. Auto loan delinquencies have been rising too, and in the subprime segment, they have been surging. Student loan delinquencies have been very high and have been underreported for years, it now turns out. So when will the first waves of consumers stumble in their debt binge and head for bankruptcy court to seek protection from creditors? That’s what everyone wanted to know. And now the answers are beginning to emerge

Credit cards don't get a dime of interest from me.

I get their $80, $150 or even $200 rebate to spend $500. Pay it off. Cancel it. Wait a year. Repeat.

Meet singles at DateHookup.dating, we're 100% free! Join now!

|

| 6/6/2017 2:29:51 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

Some have predicted a bubble in the stock market just like with the housing crisis. This could be the begining of it. I hope not. Credit cards dont make any money off me either but I'll take their $200 for playing their game.

|

| 6/6/2017 2:45:11 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

sinceresammy

Dayton, OH

62, joined Mar. 2014

|

Most of the above is true concerning debt, but interest rates are low and more people are working having the income to service their debt.

However, student loan debt is a big problem, but our great leader may give them a partial pass on some of it.

|

| 6/6/2017 3:06:24 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

People fold too easy on their debt. They don't want to eat beans and rice to get their finances in order. I went out with a guy who filed bankruptcy. After court he took a mini vacation to celebrate. Never saw him again. I'm sure he is well on his way to be eyeballs deep in debt.

|

| 6/6/2017 3:09:12 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

Olaf_the_german

Houston, TX

50, joined Feb. 2017

|

Well you can eat beans and rice or you can exploit a shitty system and still have steak...

|

| 6/6/2017 3:16:03 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

I think its best to never take out the loans you feel are crappy.

|

| 6/6/2017 3:19:24 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

archer513

Cincinnati, OH

43, joined Dec. 2014

|

I get all of my finance advice from iam res...

|

| 6/6/2017 3:22:01 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

Olaf_the_german

Houston, TX

50, joined Feb. 2017

|

I think its best to never take out the loans you feel are crappy.

Crappy system, not crappy loans...any system that allows people to borrow thousands with no (or rarely) any criminal repercussions is a crappy system.

Of course certain people will exploit that but then as the black folk say...don't hate the player, hate the game...or whatever those black fools say.

If you borrow thousands and can't pay it back it should be viewed the same as any other grand theft...30 yrs hard labor.

[Edited 6/6/2017 3:23:32 PM ]

|

| 6/6/2017 3:30:49 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

Like Don Henley wrote,

"You can arm yourself, alarm yourself

But there's nowhere you can run

'Cause a man with a briefcase

Can steal more money

Than any man with a gun".

From the song,"Gimme What You Got".

|

| 6/6/2017 3:55:27 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

Olaf I agree with you to an extent. Some people borrow money and never have any intention of paying it back.

|

| 6/6/2017 4:25:04 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

A Honduran immigrant and single mother with one child in Silver Spring, Maryland, decided not to renew the food stamps she received when they expired in January. "We fear deportation," said the 29-year-old immigrant, who also spoke on condition of anonymity and was introduced to AP through a local nonprofit. She normally earns about $350 per week answering phones at a travel agency but has been working extra hours cleaning homes to make up for the loss of about $150 per month in food stamps.

Mark Krikorian, a well-known advocate for reducing immigration to the U.S., said their situation reflects the fact that many people who come to the country lack the skills to earn enough money here. "It is an attempted moral blackmail to say 'If you Americans don't give me your money, I can't stay here and feed my children,'" he said. "Well, it's your choice. No one made you sneak into the United States."

About 3.9 million citizen children living with noncitizen parents received food stamps in the 2015 fiscal year, the most recent available data, according to the Department of Agriculture, which administers the food stamp program.

[Edited 6/6/2017 4:26:00 PM ]

|

| 6/6/2017 4:28:07 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

pento4

Norman, OK

48, joined Mar. 2017

|

I dont owe anybody shit,

|

| 6/6/2017 4:32:03 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

Except taxes,income and property.

F**k the Fed.

|

| 6/6/2017 4:38:33 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

bumblebee7

Fort Payne, AL

62, joined Apr. 2011

|

I get all of my finance advice from iam res...

|

| 6/6/2017 5:02:10 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

Actually, I wanna die owing the credit card companies about $100,000.

And leave a note saying,"Come and get it fukers".

Here's my address. 666 Cemetery Lane,Bum F**k,Egypt.

[Edited 6/6/2017 5:03:26 PM ]

|

| 6/6/2017 5:09:56 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

cheep_trick

Herndon, VA

37, joined Mar. 2017

|

Many people, borrow far more,

than they'll ever be able to pay back.

|

| 6/6/2017 5:17:05 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

Just like the United States government.

All fiat currency that has ever existed has failed.

Every Single One.

|

| 6/6/2017 5:24:10 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

M4mischief

Grand Prairie, TX

99, joined May. 2016

|

Everything goes up but the wages stay the same...most people aren't earning enough to make ends meet...on the average income you cant do it...you need a two income household just for the basics like food..shelter and clothing...so the need far out ways what money is actually available to spend...credit cards look like free money until the bill comes in...and expensive housing costs...utilities and even the cost of food is driving people into the ground....add a car payment and student loans on top and theyre becoming mired knee deep in the mud....

|

| 6/6/2017 5:32:36 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

But

But

It's okay.

The top 1 percenters are getting richer.

|

| 6/6/2017 6:07:05 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

driver406

Saint Paul, MN

65, joined Oct. 2009

|

I pay all credit cards off IN FULL as well, OPie. They don't make money on me! Our generous Governor paid for my bypass. He'll get it out of my hide one day, probably when I really do croak. Paid off my student loans 3 decades ago or more! My advice to students would be to major in something practical, something you can get a good job in when you graduate and move up the ladder to bigger and better paychecks and benefits! Also, it gets you out of Mom's house, but on the other hand you have to cook and clean for yourself and do your own laundry.

|

| 6/6/2017 6:42:41 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

condor_0000

Tampa, FL

59, joined Feb. 2013

|

I think its best to never take out the loans you feel are crappy.

Crappy system, not crappy loans...any system that allows people to borrow thousands with no (or rarely) any criminal repercussions is a crappy system.

Of course certain people will exploit that but then as the black folk say...don't hate the player, hate the game...or whatever those black fools say.

If you borrow thousands and can't pay it back it should be viewed the same as any other grand theft...30 yrs hard labor.

Spoken like a true loan-shark gangster. Hey! I know! Let's break their f**king legs if they don't pay. That'll teach people to pay up! Heh, heh, heh!

|

| 6/6/2017 6:52:05 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

curbsideprophet

Tulsa, OK

42, joined Dec. 2010

|

I paid off 2 of my degrees. The last one though, between my classes being changed halfway through from a straight programming class to a web development class, I got a half a** education in computer programming and a halfass education in web development. Don't know enough of either to be useful doing anything but being irritating to people who know nothing about either.

Then we add in the predatory collection agencies straight up stealing from me. Made a deal with one, half my payment went bye bye. Wasn't applied to the debt despite words to the contrary.

Next one did the exact same thing.

3rd one I recorded the call, got a lawyer involved and raised hell when they tried to lie to me.

On the plus side, since that 3rd incident no further collection agencies have tried to contact me.

I just let them take my tax returns. F**k it, they get about the same that way as if I were making a little more than what I would've been paying monthly from the get go.

|

| 6/6/2017 6:56:15 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

condor_0000

Tampa, FL

59, joined Feb. 2013

|

Quote from easttowest72: Olaf I agree with you to an extent. Some people borrow money and never have any intention of paying it back.

========================================

Your deep love for Olaf on a host of political issues is quite revealing of who you really are. And especially so since Olaf admitted earlier in the day to being a proud Nazi.

|

| 6/6/2017 7:03:34 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

It could be I have judgements against alot of people but never seen a penny of the money. It pisses me off when I see one of them at the grocery store with new highlights, name brand clothes, buying steak. Like I said to an extent I believe there should be a debitors jail. Just like stealing.

|

| 6/6/2017 7:07:03 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

sillylaugher61

Murrysville, PA

55, joined Aug. 2011

|

It could be I have judgements against alot of people but never seen a penny of the money. It pisses me off when I see one of them at the grocery store with new highlights, name brand clothes, buying steak. Like I said to an extent I believe there should be a debitors jail. Just like stealing.

you need to contact your county clerk of courts and demand enforcement of those lawsuits.

|

| 6/6/2017 7:12:06 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

All I can do is refile every few years and put it on their credit and that cost me more money. In a way our system is crappy.

|

| 6/6/2017 8:26:13 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

sillylaugher61

Murrysville, PA

55, joined Aug. 2011

|

All I can do is refile every few years and put it on their credit and that cost me more money. In a way our system is crappy.

Here the cost go to them! you need a new clerk!!

|

| 6/6/2017 9:46:10 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

reenie4

Milwaukee, WI

60, joined Dec. 2007

|

Things that make you go hummmmm... is this why your are a criminal?

|

| 6/6/2017 9:50:18 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

sparks_01

Ocala, FL

97, joined Feb. 2017

|

|

| 6/7/2017 12:47:24 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

condor_0000

Tampa, FL

59, joined Feb. 2013

|

It could be I have judgements against alot of people but never seen a penny of the money. It pisses me off when I see one of them at the grocery store with new highlights, name brand clothes, buying steak. Like I said to an extent I believe there should be a debitors jail. Just like stealing.

Listening to all your stories about how you are constantly f**ked over by working-class people as you try desperately to be a capitalist must leave you with the firm belief that capitalism just doesn't work. Either that you're a f**king liar who's just making up shit to make raping, criminal capitalists like yourself look good and all working-class people look bad in the effort to justify your raping the f**k out of them. I suspect it's the latter. So, today we've learned that you're a Nazi and a liar. That's pretty typical of you disgusting capitalists.

[Edited 6/7/2017 12:48:16 AM ]

|

| 6/7/2017 1:20:38 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

iam_resurrected

Reno, NV

46, joined Jul. 2014

|

Great Debt Unwind: Bankruptcies by Consumers and Businesses Jump

http://wolfstreet.com/2017/06/06/bankruptcies-consumers-businesses-rise-2017/

When it comes to consumer bankruptcies, other forms of debts are the primary drivers: largely student loans, auto loans, and revolving credit such as credit cards. And a big one: debts related to medical treatments, such as emergency room bills.

And there is a lot of this debt. Credit card debt, at $1 trillion, is just one notch below the peak during the Financial Crisis. But auto loan balances outstanding have surged 36% from the pre-crisis peak in 2006 to $1.12 trillion in Q1 2017. And student loan balances outstanding have surged 180% over the same period to $1.44 trillion. This amounts to over $3.5 trillion plus medical debts.

While student loans cannot be discharged in bankruptcy, they can be drivers when other debts are involved and the combined debt burden is simply too large for consumers to carry. And they buckle.

Delinquencies on credit cards, according to the Federal Reserve Board of Governors, have been ticking up from the lows of the first half in 2015. Auto loan delinquencies have been rising too, and in the subprime segment, they have been surging. Student loan delinquencies have been very high and have been underreported for years, it now turns out. So when will the first waves of consumers stumble in their debt binge and head for bankruptcy court to seek protection from creditors? That’s what everyone wanted to know. And now the answers are beginning to emerge

Credit cards don't get a dime of interest from me.

I get their $80, $150 or even $200 rebate to spend $500. Pay it off. Cancel it. Wait a year. Repeat.

what is the BIG DEAL here?

if you choose to buy something and not pay for it today you will pay for it tomorrow with interest. it seems rather cut and dry that if you do not want debt then pay it off in the first place, duh (it's not rocket science here).

|

| 6/7/2017 1:32:48 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

condor_0000

Tampa, FL

59, joined Feb. 2013

|

what is the BIG DEAL here?

if you choose to buy something and not pay for it today you will pay for it tomorrow with interest. it seems rather cut and dry that if you do not want debt then pay it off in the first place, duh (it's not rocket science here).

The first thing that people do when faced with declining wages and rising rents and other expenses is to borrow money in the effort to maintain their current living situation. The capitalists' only concern is getting their f**king money. They know full well that it's their own raping of workers that is creating the problem, but without that raping their beloved capitalism would collapse. So, their only option is to demonize the debtors in any and every way possible. And as we all know, the first way is to tell vague, exaggerated, unsupported lies about how everyone who is poor and unable to pay off debt has a $1000 cell phone, a new 65 inch TV, a new 2017 Dodge Charger in the driveway, and just got back from a 3 week cruise to the Bahamas.

|

| 6/7/2017 1:40:57 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

iam_resurrected

Reno, NV

46, joined Jul. 2014

|

The first thing that people do when faced with declining wages and rising rents and other expenses is to borrow money in the effort to maintain their current living situation. The capitalists' only concern is getting their f**king money. They know full well that it's their own raping of workers that is creating the problem, but without that raping their beloved capitalism would collapse. So, their only option is to demonize the debtors in any and every way possible. And as we all know, the first way is to tell vague, exaggerated, unsupported lies about how everyone who is poor and unable to pay off debt has a $1000 cell phone, a new 65 inch TV, a new 2017 Dodge Charger in the driveway, and just got back from a 3 week cruise to the Bahamas.

that is what ignorant people do. if you don't have a clue about life and what to do around the age of 25, ya ain't never gonna get it when you hit 50. so, stop making excuses for the losers like yourself.

|

| 6/7/2017 5:44:32 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

The first thing that people do when faced with declining wages and rising rents and other expenses is to borrow money in the effort to maintain their current living situation. The capitalists' only concern is getting their f**king money. They know full well that it's their own raping of workers that is creating the problem, but without that raping their beloved capitalism would collapse. So, their only option is to demonize the debtors in any and every way possible. And as we all know, the first way is to tell vague, exaggerated, unsupported lies about how everyone who is poor and unable to pay off debt has a $1000 cell phone, a new 65 inch TV, a new 2017 Dodge Charger in the driveway, and just got back from a 3 week cruise to the Bahamas.

I have a tenant who went through foreclosure before she moved into one of my homes. She came with a nice dodge challenger  and a bass boat. I'm not sure about the size of her tv. She wears name brand clothes. If you saw the both of us you would think she is the landlord. and a bass boat. I'm not sure about the size of her tv. She wears name brand clothes. If you saw the both of us you would think she is the landlord.

Most people would have sold the bass boat and got rid of the new car to make their mortgage. The house they lived in had to have been financed beyond what it is worth. She had been in her home for 26 years. The mortgage I was paying 26 years ago would be a drop in a bucket compared to today's prices. But then again, I didnt refinances to fund an extravagant lifestyle.

[Edited 6/7/2017 5:45:46 AM ]

|

| 6/7/2017 6:00:04 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

what is the BIG DEAL here?

if you choose to buy something and not pay for it today you will pay for it tomorrow with interest. it seems rather cut and dry that if you do not want debt then pay it off in the first place, duh (it's not rocket science here).

Tell that to the United States government and their fiat currency scam.

Borrowing "currency" into infinity and beyond.

|

| 6/7/2017 6:14:11 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

stanleyzee

Dayton, OH

60, joined Dec. 2012

|

Actually, I wanna die owing the credit card companies about $100,000.

And leave a note saying,"Come and get it fukers".

Here's my address. 666 Cemetery Lane,Bum F**k,Egypt.

Federal reserve Treasury department

[Edited 6/7/2017 6:15:23 AM ]

|

| 6/7/2017 6:25:29 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

I'm so serious though.

Amazon's and Walmart's latest moves confirm the death of the middle class as we know it.

https://finance.yahoo.com/news/amazon-walmarts-latest-moves-confirm-203539327.html

The two retailers' strategies of aiming at the furthest ends of the income spectrum highlight the widening gap between wealthy and poor Americans and the disappearance of what was once the most sought-after class of income-earners in the country.

"This is absolutely symptomatic of a deteriorating middle class, or at least what we used to consider to be the middle class in America," Stephens told Business Insider.

|

| 6/7/2017 6:27:09 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

pento4

Norman, OK

48, joined Mar. 2017

|

Quote from easttowest72: Olaf I agree with you to an extent. Some people borrow money and never have any intention of paying it back.

========================================

Your deep love for Olaf on a host of political issues is quite revealing of who you really are. And especially so since Olaf admitted earlier in the day to being a proud Nazi.

Yet you are a communist with Cuba only 90mi away & a a lifted travel ban. And well, Venezuela needing all the help it can get from like minded peeps right now. Yet you still wont leave,,Just continue to play keyboard warrior from moms basement in Tampa

|

| 6/7/2017 6:49:25 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

stanleyzee

Dayton, OH

60, joined Dec. 2012

|

I'm so serious though.

Amazon's and Walmart's latest moves confirm the death of the middle class as we know it.

https://finance.yahoo.com/news/amazon-walmarts-latest-moves-confirm-203539327.html

The two retailers' strategies of aiming at the furthest ends of the income spectrum highlight the widening gap between wealthy and poor Americans and the disappearance of what was once the most sought-after class of income-earners in the country.

"This is absolutely symptomatic of a deteriorating middle class, or at least what we used to consider to be the middle class in America," Stephens told Business Insider.

|

| 6/7/2017 7:35:46 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

Some people want to make a living by running up debt and filing bankruptcy.

|

| 6/7/2017 8:40:15 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

sinceresammy

Dayton, OH

62, joined Mar. 2014

|

I regularly borrow hundred of thousands of dollars at low interest rates to leverage my portfolios. America is a great place!

If you have a judgement against someone, the county clerk won't offer you any help except to refile the judgement. You have to institute collection procedures. You can have their wages garnished, attach their property, or send Mongo to break their legs!

Garnishment and attachment involve some paperwork and knowing where they work or be able to identify what they own. The best course of action is to carefully select tenets and insist on a substantial deposit! You might check with Dr Haggy, since he is in the rental game!

|

| 6/7/2017 8:52:44 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

Olaf_the_german

Houston, TX

50, joined Feb. 2017

|

Some people want to make a living by running up debt and filing bankruptcy.

The problem are not the people who take advantage of loopholes, but the loopholes themselves.

|

| 6/7/2017 8:59:19 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

stratus55

Jackson, GA

51, joined Jan. 2017

|

screw it all..someone has made thereself a total judge..a challenger is cool,,bassboat is total redneck..maybe full of pabst blue ribbons,worse than stale piss cans...judge not..let it all go..leave everyone alone.............

|

| 6/7/2017 9:34:30 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

sinceresammy

Dayton, OH

62, joined Mar. 2014

|

^DH always has the premium morons submitting their views on the state of the world's affairs!

|

| 6/7/2017 9:48:17 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

screw it all..someone has made thereself a total judge..a challenger is cool,,bassboat is total redneck..maybe full of pabst blue ribbons,worse than stale piss cans...judge not..let it all go..leave everyone alone.............

[Edited 6/7/2017 9:48:45 AM ]

|

| 6/7/2017 9:53:31 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

enigmaathand

Leavittsburg, OH

36, joined Mar. 2013

|

Sounds to me like Americans need to stop practicing like Congress, and learn to live within their budget.

My house? Paid Cash for it and fixed it up.

My Cars? Paid cash for and fixed them up.

College? Hah! Only an idiot think college makes you smart. Most college material can be found and self-taught on YouTube or with Google searches now.

I have no sympathy for idiots, that buy brand new cars for $50,000, or spend $150,000 on a 4-year degree, when they work at McDonald's and complain about how they want $15/hr....

|

| 6/7/2017 10:02:44 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

iam_resurrected

Reno, NV

46, joined Jul. 2014

|

Tell that to the United States government and their fiat currency scam.

Borrowing "currency" into infinity and beyond.

so what, pay in cash or have the finances to pay something off first so you do not have to charge it. the key here though: [if] you have capital and do use financing, and if you do not pay and go bankrupt, you still keep most of your capital.

why the law only allows so many [personal bankruptcies] vs [filing under business articles].

if you go back to the founding fathers and read the idealisms of Jefferson and Adams, you will discover their system is designed for what took place with TRUMP. "the people will give their RIGHTS away and the government will own it all."

this is evident when Jefferson made the statement " citizens of America govern themselves in all mannerisms and will continue until the government chooses to no longer allow it."

this took place when police were created. a way to control society from the ground up. it would only make sense then the government will also financially break you.

now it becomes are you smarter than them. can you live by your needs only under the provision of your means. the [want] sh*t has gotta go or you are flat out going to fail.

if you are a mechanic: then all your expenditures should go to tools, building cost/maintenance, utilities. you charge based upon need only [new alternator is (cost of alternator plus $10.00 + labor)(not the mcdonalds you shoved down your throat picking up the new alternator).

|

| 6/7/2017 10:04:17 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

condor_0000

Tampa, FL

59, joined Feb. 2013

|

I have a tenant who went through foreclosure before she moved into one of my homes. She came with a nice dodge challenger  and a bass boat. I'm not sure about the size of her tv. She wears name brand clothes. If you saw the both of us you would think she is the landlord.

Most people would have sold the bass boat and got rid of the new car to make their mortgage. The house they lived in had to have been financed beyond what it is worth. She had been in her home for 26 years. The mortgage I was paying 26 years ago would be a drop in a bucket compared to today's prices. But then again, I didnt refinances to fund an extravagant lifestyle.

It's funny how every rich capitalist parasite like yourself, eager to blame the victims of your capitalist rapefest for their plight, personally knows several workers who have a big expensive house, several new cars, a couple of big-screen TVs, the latest Apple cell phone, the finest designer clothes, all on $10 per hour -- and now, the scum that they are, these workers can't pay their debts. Meanwhile, I don't know personally anybody at all like that. And how is it that you rich capitalists are hanging around with working-class scum all the time?

---------

More than 500,000 homeless in the US

By Kate Randall

21 November 2015

World Socialist Web Site

https://www.wsws.org/en/articles/2015/11/21/home-n21.html

Excerpts:

More than a half million people were homeless in the United States this year, nearly a quarter of them children, according to a new report. The homelessness crisis is a stark indicator of the social reality in 2015 America and corresponds to a scarcity of affordable housing and dwindling wages for low-income workers and their families.

The report from the US Department of Housing and Urban Development (HUD) released Thursday counted 564,708 people homeless, both sheltered and unsheltered. These figures, gathered by volunteers on a given night in January 2015, are undoubtedly an undercount. Many of those living in motels, doubling up with relatives and friends or living on the streets are likely not represented in the tally.

Twenty-three percent, or 127,787, of the nation’s homeless are children under the age of 18, according to HUD. However, this figure is at odds with statistics from another branch of the federal government. According to the Department of Education, there are 1.36 million homeless students in the nation’s K-12 public schools, double the number in 2006, before the onset of the financial collapse.

According to the National Alliance to End Homelessness, there is a shortage of 7 million units of affordable housing throughout the US, creating a desperate situation for workers and their families as they search for decent and affordable accommodations.

As the majority of working people feel the housing squeeze, they face declining real wages. According to a recent National Employment Law Projet report, workers’ wages have declined by 4 percent, after adjusting for inflation, between 2009 and 2014.

More than one in ten homeless adults are veterans. There were 47,725 homeless veterans on a single night in January 2015, or 11 percent of the 436,921 homeless adults. Veterans from the wars in Iraq and Afghanistan, Vietnam, Korea and the countless US imperialist exploits are included in this total.

Despite the massive increase in homelessness since the beginning of the financial crisis, funding for public housing has been repeatedly slashed in the post-2009 period. A report by the San Francisco-based Western Regional Advocacy Project noted that “HUD funding for new public housing units...has been zero since 1996,” while “Capital available to perform maintenance in 2012 [was] $1,875 billion,” representing a fall of $625 million over three years.

Mass homelessness is only the most acute manifestation of America’s housing crisis. According to a study published by Harvard University’s Joint Center For Housing Studies in June, the homeownership rate for 35-44 year-olds, which has been plunging for decades, has hit the lowest levels since the 1960s. Only slightly more than one-third of households headed by those aged 25-35 own their own homes.

The persistence of mass homelessness in the United States, despite six years of “economic recovery,” is an expression of the persistence of mass unemployment, falling wages, the slashing of social services, and the increasingly unaffordable living costs in America’s major cities, including Los Angeles and New York, that are home to a disproportionate share of America’s billionaires.

According to a poll released earlier this month, half of New Yorkers are “either just getting by or finding it difficult to manage financially.” More than one in five said they did not have enough money to buy food over the past year, and 17 percent said that they “have had times over the last year when they lacked the money to provide adequate shelter for their family.”

In the New York borough of Manhattan, median rent prices have grown by 9.5 percent over the past year. To afford a typical Manhattan apartment, one would have to pay over $40,000 a year in rent alone, 30 percent higher than the median wage in the United States. Not surprisingly, one recent study found that it is impossible for any worker making the minimum wage of $8.75 per hour to afford an apartment in any part of New York City—defined as spending no more than 30 percent of monthly income on rent.

[Edited 6/7/2017 10:05:54 AM ]

|

| 6/7/2017 10:15:09 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

sinceresammy

Dayton, OH

62, joined Mar. 2014

|

No day is complete without a page or two of gibberish from I'm(a POS).

|

| 6/7/2017 10:16:27 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

She is older than I am. All her children are grown. When she moved in it was a 3 income household. Her grown working son came with them. Please stop the crybaby crap.

|

| 6/7/2017 10:24:49 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

sillylaugher61

Murrysville, PA

55, joined Aug. 2011

|

I'm not complaining. She has paid me $57,000. I'm just explaining that most of the time people's financial problems are their own stupidity.

What you are saying many people sadly don't want to hear.

|

| 6/7/2017 10:30:26 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

Silly that is so true

|

| 6/7/2017 10:34:41 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

enigmaathand

Leavittsburg, OH

36, joined Mar. 2013

|

It's funny how every rich capitalist parasite like yourself, eager to blame the victims of your capitalist rapefest for their plight, personally knows several workers who have a big expensive house, several new cars, a couple of big-screen TVs, the latest Apple cell phone, the finest designer clothes, all on $10 per hour -- and now, the scum that they are, these workers can't pay their debts. Meanwhile, I don't know personally anybody at all like that. And how is it that you rich capitalists are hanging around with working-class scum all the time?

---------

More than 500,000 homeless in the US

By Kate Randall

21 November 2015

World Socialist Web Site

https://www.wsws.org/en/articles/2015/11/21/home-n21.html

Excerpts:

More than a half million people were homeless in the United States this year, nearly a quarter of them children, according to a new report. The homelessness crisis is a stark indicator of the social reality in 2015 America and corresponds to a scarcity of affordable housing and dwindling wages for low-income workers and their families.

The report from the US Department of Housing and Urban Development (HUD) released Thursday counted 564,708 people homeless, both sheltered and unsheltered. These figures, gathered by volunteers on a given night in January 2015, are undoubtedly an undercount. Many of those living in motels, doubling up with relatives and friends or living on the streets are likely not represented in the tally.

Twenty-three percent, or 127,787, of the nation’s homeless are children under the age of 18, according to HUD. However, this figure is at odds with statistics from another branch of the federal government. According to the Department of Education, there are 1.36 million homeless students in the nation’s K-12 public schools, double the number in 2006, before the onset of the financial collapse.

According to the National Alliance to End Homelessness, there is a shortage of 7 million units of affordable housing throughout the US, creating a desperate situation for workers and their families as they search for decent and affordable accommodations.

As the majority of working people feel the housing squeeze, they face declining real wages. According to a recent National Employment Law Projet report, workers’ wages have declined by 4 percent, after adjusting for inflation, between 2009 and 2014.

More than one in ten homeless adults are veterans. There were 47,725 homeless veterans on a single night in January 2015, or 11 percent of the 436,921 homeless adults. Veterans from the wars in Iraq and Afghanistan, Vietnam, Korea and the countless US imperialist exploits are included in this total.

Despite the massive increase in homelessness since the beginning of the financial crisis, funding for public housing has been repeatedly slashed in the post-2009 period. A report by the San Francisco-based Western Regional Advocacy Project noted that “HUD funding for new public housing units...has been zero since 1996,” while “Capital available to perform maintenance in 2012 [was] $1,875 billion,” representing a fall of $625 million over three years.

Mass homelessness is only the most acute manifestation of America’s housing crisis. According to a study published by Harvard University’s Joint Center For Housing Studies in June, the homeownership rate for 35-44 year-olds, which has been plunging for decades, has hit the lowest levels since the 1960s. Only slightly more than one-third of households headed by those aged 25-35 own their own homes.

The persistence of mass homelessness in the United States, despite six years of “economic recovery,” is an expression of the persistence of mass unemployment, falling wages, the slashing of social services, and the increasingly unaffordable living costs in America’s major cities, including Los Angeles and New York, that are home to a disproportionate share of America’s billionaires.

According to a poll released earlier this month, half of New Yorkers are “either just getting by or finding it difficult to manage financially.” More than one in five said they did not have enough money to buy food over the past year, and 17 percent said that they “have had times over the last year when they lacked the money to provide adequate shelter for their family.”

In the New York borough of Manhattan, median rent prices have grown by 9.5 percent over the past year. To afford a typical Manhattan apartment, one would have to pay over $40,000 a year in rent alone, 30 percent higher than the median wage in the United States. Not surprisingly, one recent study found that it is impossible for any worker making the minimum wage of $8.75 per hour to afford an apartment in any part of New York City—defined as spending no more than 30 percent of monthly income on rent.

Come to NE Ohio, where you can see the "rich, capitalist" parasites with all that stuff, while sitting on welfare or disability, popping out kid after kid, living in Section 8 housing, while the "working class Socialists" are living paycheck to paycheck and surviving on Top Ramen

You always want to point your entitled, lazy fingers at the "rich" and wealthy, but the REAL parasites are the ones sitting on a government handout.

The working-class SPENDS their money, hence why the economy exists. The RICH horde their money and protect it.

The Parasitic Welfare bums cause unnecessary load on government budgets, which results in excessive taxation(I pay almost 30% of my paycheck, every week, in TAXES), thus REDUCING the amount of SPENDING MONEY from the American worker.

You seem to think because a person has billions of dollars, like Bill Gates for instance, that they should just hand it over to somebody that needs money.

However, you fail to realize and acknowledge this point:

Most of those claiming to "need" it, have the means to "get" it themselves. They are just lazy and want somebody else to do it for them.

I "need" about $7,400 more, before I am completely debt free(buying my Saturn and rebuilding it put me behind about $3,000).

Now, I have two choices:

I can sit around whining and hoping some stupid stiff just hands me the $7,400 for NOTHING(Like YOU think the way things should be), OR

I can put on a pair of work boots, bust my a** for 12 hours a day operating machinery and learning a skill, while getting paid the money I "need" to get ky debt issues resolved(Which I am not in default and never have been in default, because I CHOOSE option #2, ironically)

The rich didn't burden me with that debt, BUT the lazy a** "poor" that you want to stand up for like some kind of modern-day "Robin Hood"???

Well, see, they add so much burden to me, that I ak weighed down to living on bare necessities, thanks to all the money the government takes from me, to act like you.

|

| 6/7/2017 10:35:04 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

stanleyzee

Dayton, OH

60, joined Dec. 2012

|

East the accountant stockbroker financial planner

|

| 6/7/2017 11:10:37 AM |

And here we go. Again. "They" never learn or that is their plan. |

|

easttowest72

Bremen, GA

45, joined Sep. 2014

|

Its not hard to do simple math. The hard part is living within your means. People will spend money on frivolous things knowing they won't be able to pay their bills. I have friends that will charge dinner on their credit cards rather than get off their a** and cook. We all seen comedies about shoppers. This country is full of entitled people.

|

| 6/7/2017 12:28:19 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

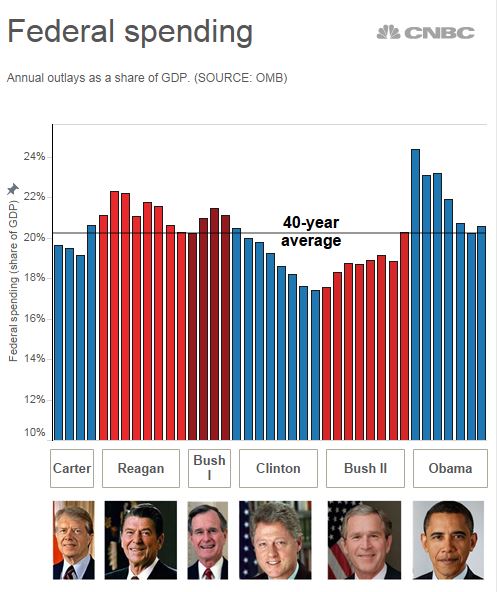

Tax policy plays a major role in determining whether we run surpluses or deficits. Many factors probably contributed to the budget surpluses of the 1990s, but one of them was tax increases, which took the form of tax rate increases for the highest income taxpayers-Clinton tax raises on the rich (although rates stayed well below what they had been prior to the 1980s-Reagan lowered taxes for the rich. Think trickle down economics). Likewise, major tax cuts in 2001 and 2003-Bush lowered taxes for the rich were a major contributor to deficits over the last decade, and to today's debt - by some measures, even more so than the economic downturn.

|

| 6/7/2017 3:20:27 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

condor_0000

Tampa, FL

59, joined Feb. 2013

|

This country is full of entitled people.

Yes it is. We call them "capitalists."

|

| 6/7/2017 3:42:26 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

Olaf_the_german

Houston, TX

50, joined Feb. 2017

|

Yes it is. We call them "libtards and sjw."

Fixed.

|

| 6/7/2017 5:10:28 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

condor_0000

Tampa, FL

59, joined Feb. 2013

|

Yes it is. We call them "libtards and sjw."

Fixed.

"Waaaaaaaaa! We ran our Ponzi-scheme investments to the point of bankrupting ourselves and destroying our beloved capitalist system. We want trillions of dollars in bailouts! We are entitled! We don't want to have to work for a living like everyone else We are the entitled!" -- Capitalists

|

| 6/7/2017 6:15:31 PM |

And here we go. Again. "They" never learn or that is their plan. |

|

criminal_1

FPO, AP

98, joined Jan. 2017

|

And they got them with the so called "too big to fail" bullshit.

They gamble and lose and get bailed out.

|